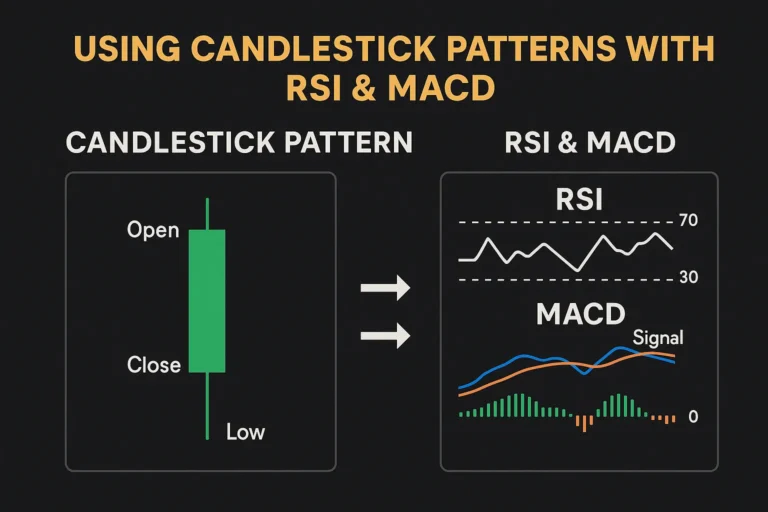

Using Candlestick Patterns with RSI & MACD for Accuracy

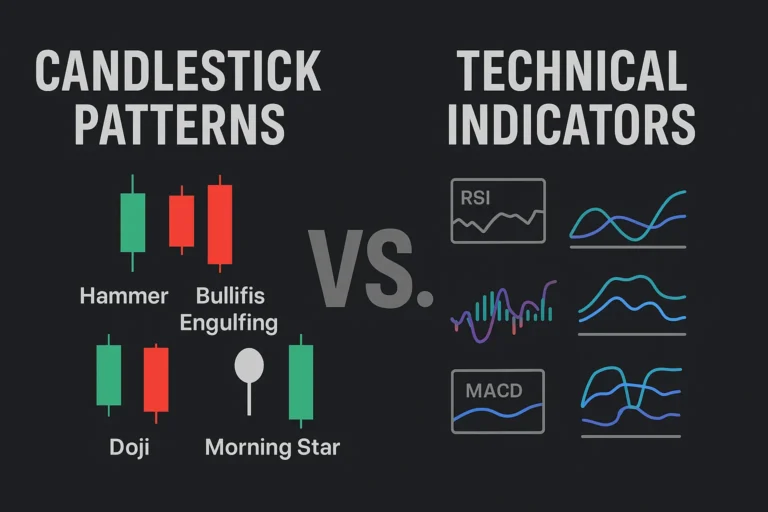

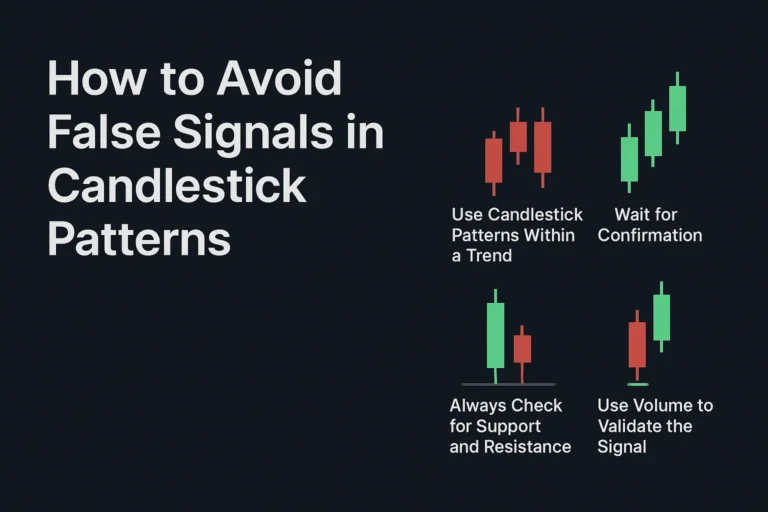

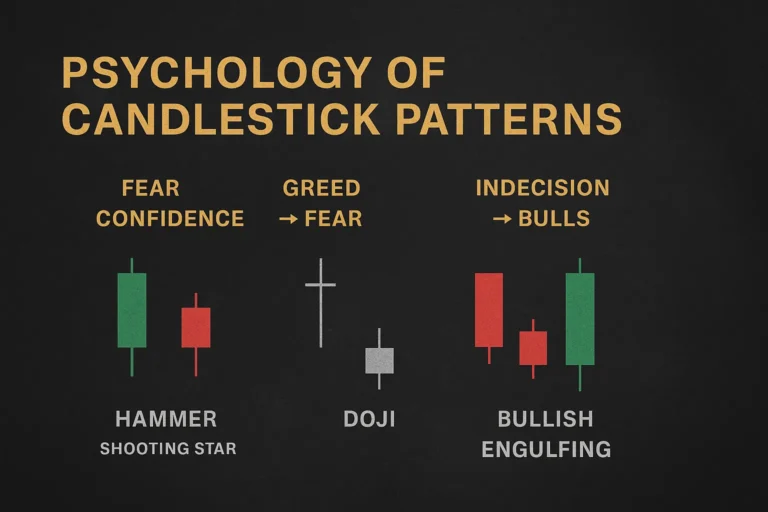

Candlestick patterns offer a clear view of market sentiment, but combining them with technical indicators like RSI and MACD can greatly increase your accuracy and confidence. Together, they form a powerful confluence that helps traders make better decisions. In this guide, you’ll learn how to effectively use candlestick patterns with RSI and MACD to boost…