How to Avoid False Signals in Candlestick Patterns

Candlestick patterns are powerful, but they can also be misleading — especially when taken at face value without proper context. Many traders fall into the trap of acting too quickly on a pattern, only to face losses when the signal turns out to be false.

In this guide, you’ll learn how to avoid false signals in candlestick patterns by using proven strategies and smarter analysis.

What Are False Candlestick Signals?

A false candlestick signal occurs when a pattern seems to suggest a trend reversal or continuation but fails to play out as expected. This results in whipsaws, fake breakouts, and premature entries that hurt your win rate.

Why Do False Signals Happen?

- Lack of volume confirmation

- Forming in a sideways/choppy market

- Ignoring the broader trend or support/resistance

- Acting without waiting for confirmation

- Relying solely on single-candle patterns in isolation

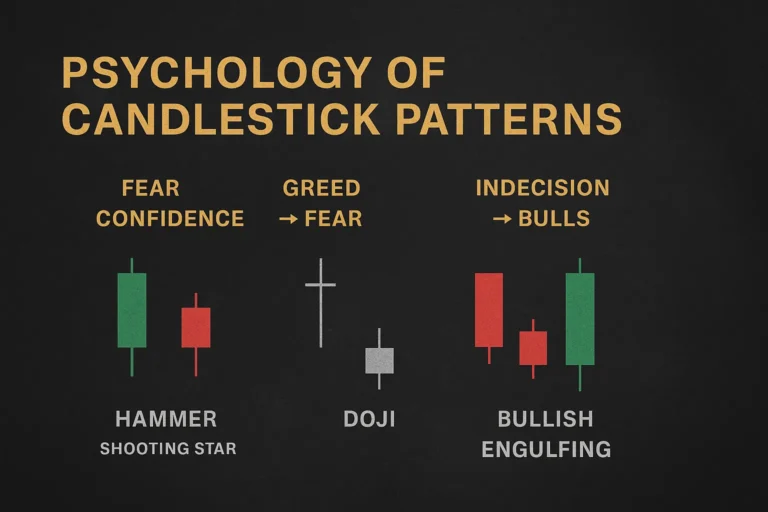

1. Use Candlestick Patterns Within a Trend

Candlestick patterns are most reliable when they align with the prevailing trend.

- In an uptrend, focus on bullish continuation or reversal patterns (e.g., Bullish Engulfing, Hammer).

- In a downtrend, prioritize bearish patterns (e.g., Shooting Star, Bearish Engulfing).

Avoid using reversal patterns against strong trends unless there is clear support/resistance or divergence.

2. Wait for Confirmation

Confirmation is the most important rule to filter false signals. Don’t act based on a pattern alone—wait for the next candle to:

- Close in the direction of the pattern

- Break a key level (support/resistance)

- Show increased volume or price momentum

Example: After a Bullish Engulfing, wait for the next green candle to break the previous high before entering.

3. Always Check for Support and Resistance

Patterns that form near key levels are more trustworthy.

- A Hammer near support has high reversal potential.

- A Shooting Star at resistance signals potential selling pressure.

Candlesticks floating in the middle of a range often fail.

4. Use Volume to Validate the Signal

Volume is the fuel behind price moves. Without it, a pattern lacks conviction.

- Bullish patterns should show rising volume on breakout candles.

- Bearish patterns should have declining volume after exhaustion candles.

Low volume signals may indicate a lack of real participation.

5. Avoid Trading in Ranging or Low-Volatility Markets

Candlestick patterns often fail in sideways markets or periods of low volatility.

Look for:

- Breakouts from consolidation zones

- Clean price swings

- Strong trends with clear structure

Choppy price action creates confusing and unreliable signals.

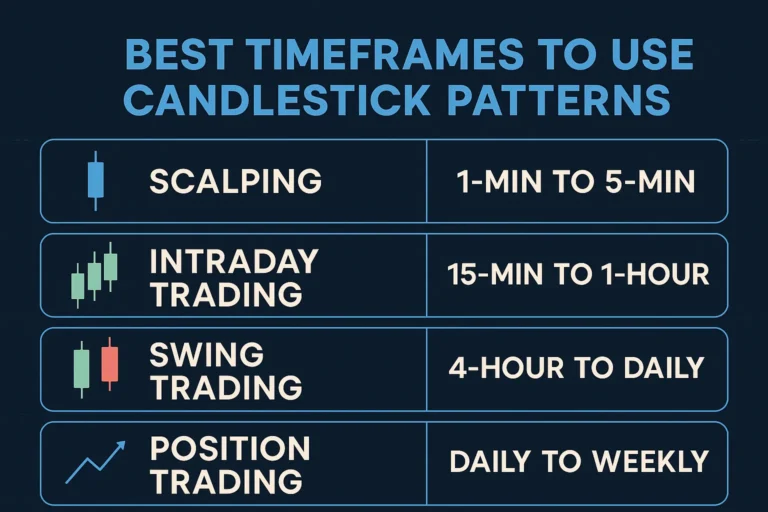

6. Use Multiple Timeframe Confirmation

A pattern on a lower timeframe (e.g., 15-min) is more reliable when it aligns with a trend or level on a higher timeframe (e.g., 1H, 4H).

Example: A Doji on the 15-min chart is more meaningful if it appears near daily support.

7. Avoid Overtrading Every Pattern

Not all candlestick patterns need to be traded. Choose only high-probability setups with:

- Trend alignment

- Key level proximity

- Volume confirmation

- Follow-through momentum

Fewer trades = better performance.

Conclusion

Avoiding false candlestick signals is about discipline, context, and confirmation. Don’t chase every pattern you see — instead, look for the story behind the candles, and combine patterns with smart filters like trend, levels, and volume.

With this approach, your candlestick trading will become more accurate and consistent.

FAQs

1. Why do candlestick patterns fail sometimes?

They fail due to lack of context, confirmation, or occurring in ranging markets.

2. Can I use indicators to reduce false signals?

Yes. RSI, MACD, or moving averages can confirm momentum or divergence.

3. Are single-candle patterns more prone to false signals?

Yes. Multi-candle patterns like Engulfing or Morning Star are more reliable.

4. How important is volume in candlestick trading?

Very. It shows the strength or weakness behind price movements.

5. Can I rely on candlestick patterns alone?

No. Use them with support/resistance, trend analysis, and other tools for best results.