Bearish Engulfing Pattern: Signals and Examples

The Bearish Engulfing pattern is one of the most recognized candlestick signals for spotting potential market reversals at the top of an uptrend. This simple two-candle formation reveals a shift in sentiment from buyers to sellers—and it often triggers powerful downward moves when confirmed with other signals.

In this guide, we’ll break down the Bearish Engulfing pattern, how to identify it, and when to trade it effectively.

What Is a Bearish Engulfing Pattern?

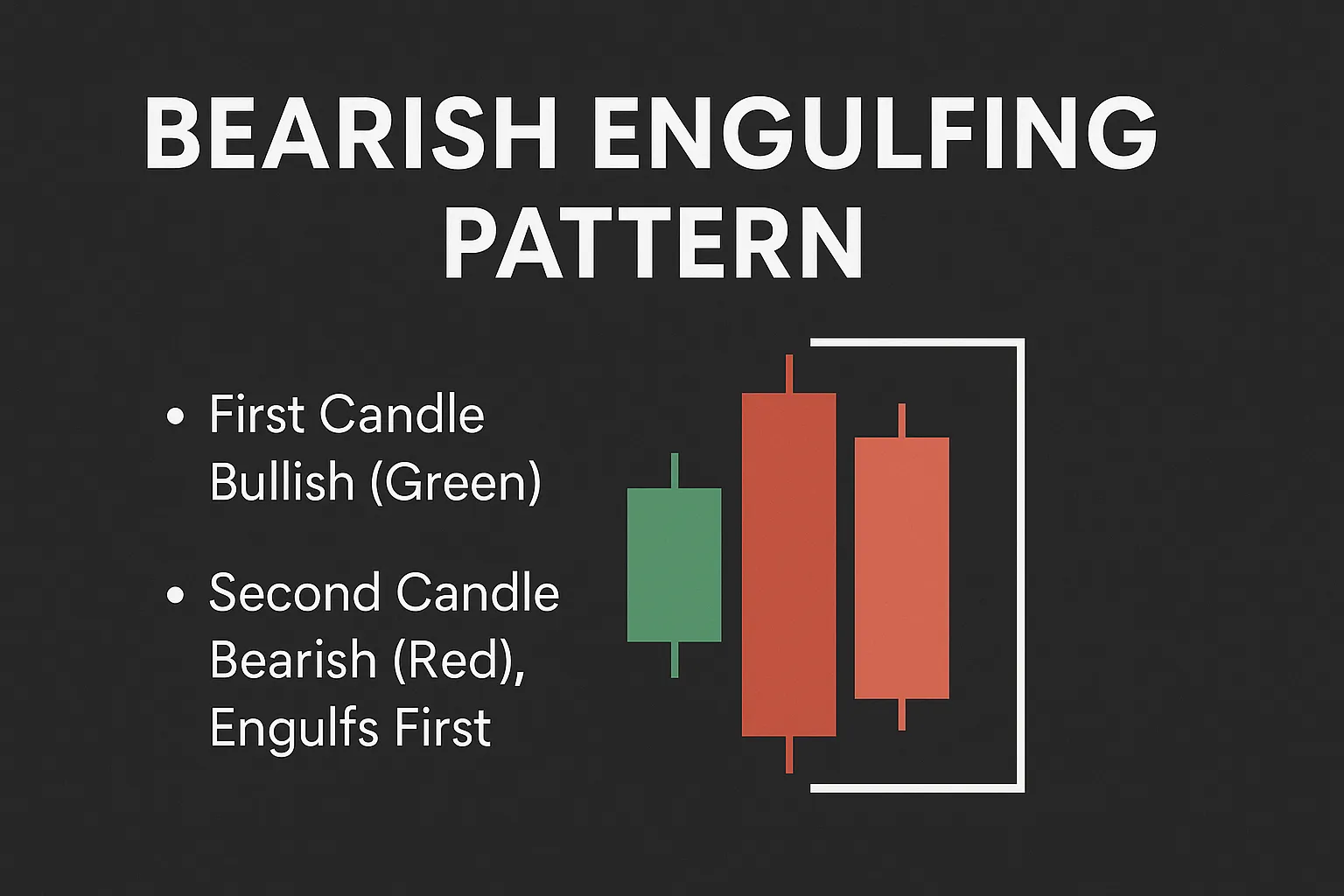

The Bearish Engulfing is a two-candle reversal pattern that appears after an uptrend or bullish move.

Key Features:

- First Candle: A small bullish (green) candle

- Second Candle: A large bearish (red) candle that completely engulfs the body of the first candle

- The pattern signals a shift in control from buyers to sellers

The second candle’s close is lower and its open is higher than the first candle’s range, making it a strong reversal signal.

What It Tells Traders

This pattern shows that buyers tried to continue the uptrend but failed. Sellers stepped in with force, overwhelming the prior gains and suggesting that a top may be forming.

It’s especially powerful when it appears near resistance levels, overbought zones, or after a parabolic move.

How to Identify a Bearish Engulfing Pattern

- Must appear after a clear uptrend or bullish swing

- The first candle is bullish with a small real body

- The second candle is bearish and fully covers the first candle’s body

- Preferably accompanied by higher volume on the second candle

- The second candle’s close is near its low, showing strong selling pressure

Example Chart Scenario

Imagine a stock trending upward. On one session, a small green candle forms. The next day, a red candle opens above the green candle’s high but closes below its low.

This strong bearish move “engulfs” the previous bullish sentiment and often leads to a retracement or full trend reversal.

Trading the Bearish Engulfing Pattern

✅ Entry Point:

- Enter a short position after the bearish engulfing candle closes

- Or wait for a minor pullback or retest of the engulfing candle’s high

✅ Stop Loss:

- Place SL above the high of the engulfing candle

- Conservative traders can place it above resistance

✅ Profit Target:

- Use recent support levels or a 1:2 risk-reward ratio

- For trend traders, trail stops to capture more downside

Ideal Conditions for High Probability

- Appears at resistance or key supply zones

- Confirmed with RSI divergence or overbought levels

- Shows increased volume on the second candle

- Backed by trendline rejection or upper Bollinger Band touch

Common Mistakes to Avoid

- Trading the pattern in isolation without trend or level context

- Mistaking inside bars or small candles for true engulfing

- Ignoring volume—a quiet reversal is less reliable

- Forcing trades in choppy or sideways markets

Bearish Engulfing vs Bullish Engulfing

| Feature | Bearish Engulfing | Bullish Engulfing |

|---|---|---|

| Trend Location | After uptrend | After downtrend |

| Candle 1 | Bullish | Bearish |

| Candle 2 | Bearish (engulfs C1) | Bullish (engulfs C1) |

| Signal | Bearish reversal | Bullish reversal |

Conclusion

The Bearish Engulfing pattern is a high-impact candlestick signal that every trader should know. When combined with trend context, support/resistance, and volume analysis, it can dramatically improve your trade entries and timing.

If you’re looking for a simple, powerful pattern to spot potential tops, this one should be on your radar.

FAQs

1. Is the Bearish Engulfing pattern always reliable?

It’s more reliable when confirmed with trend context, volume, and resistance levels.

2. Can I use it for intraday trading?

Yes. The pattern works on all timeframes—1-min to daily—but higher timeframes are more reliable.

3. Should I wait for confirmation after the pattern forms?

Yes. It’s safer to wait for the next candle to confirm the bearish momentum.

4. Is volume important in a Bearish Engulfing setup?

Absolutely. Higher volume on the second candle adds strength to the signal.

5. What if the engulfing candle is huge?

Use proper risk management. The larger the candle, the wider the stop-loss needs to be.