Best Timeframes to Use Candlestick Patterns

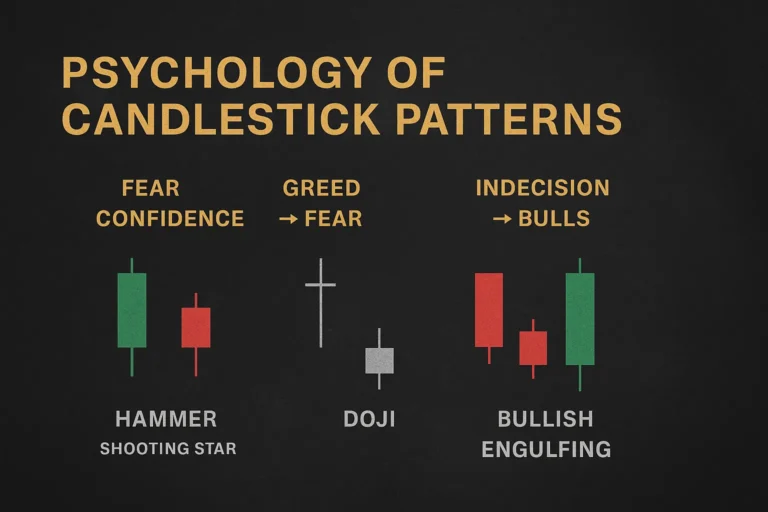

Candlestick patterns work across all markets, but their effectiveness heavily depends on the timeframe you choose. A pattern that looks strong on a 1-minute chart might be noise, while the same setup on a daily chart could signal a high-probability trade.

In this guide, we’ll explore the best timeframes to use candlestick patterns, how they differ across markets, and which timeframe suits your trading style.

Why Timeframe Matters in Candlestick Analysis

Every candlestick represents price movement over a specific period—1 minute, 5 minutes, 1 hour, 1 day, etc. The larger the timeframe, the stronger the signal, because it reflects decisions made by more traders and institutions.

Lower timeframes offer more frequent setups but also more false signals due to market noise.

Common Trading Timeframes

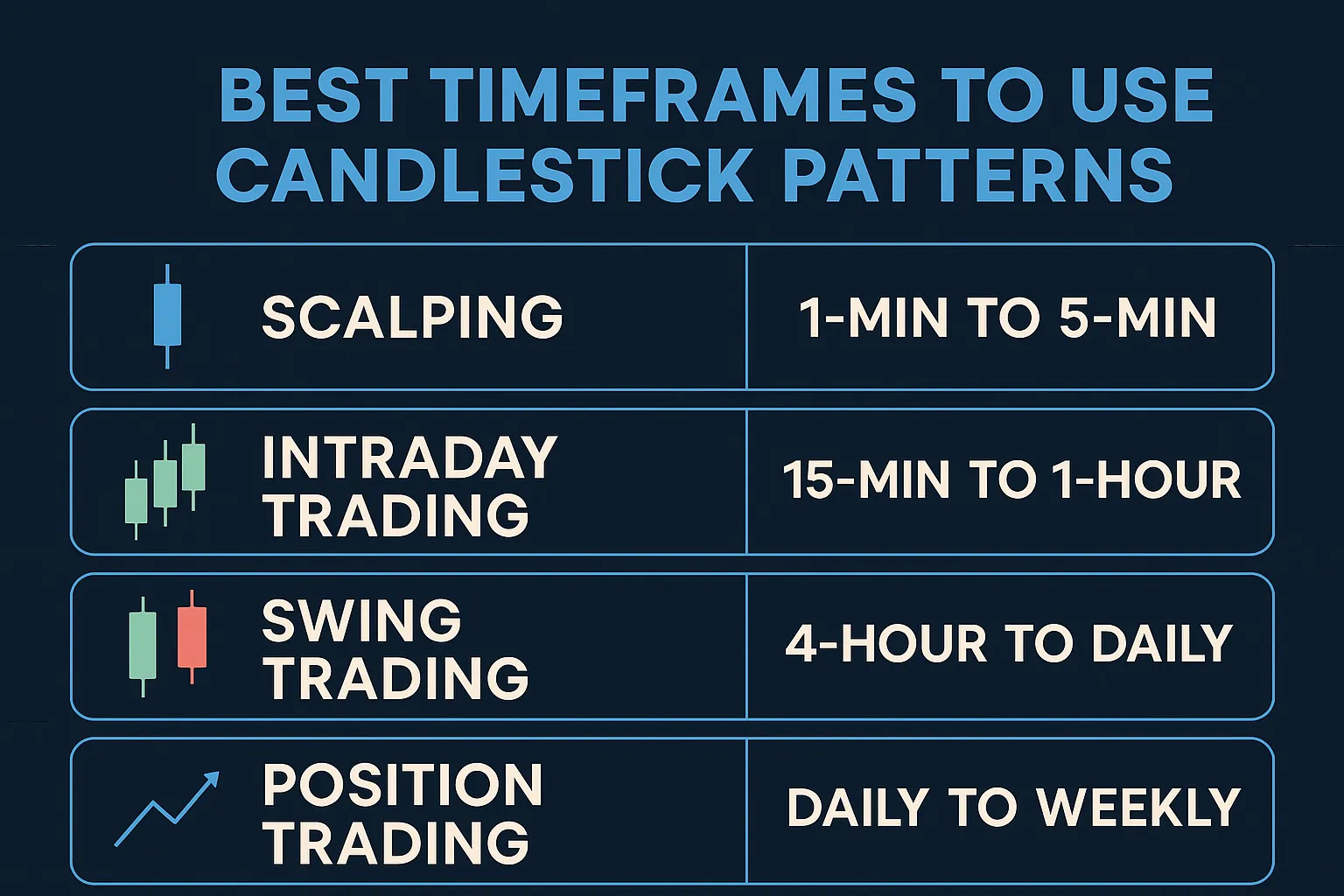

| Timeframe | Type of Trader | Description |

|---|---|---|

| 1-Min to 15-Min | Scalpers | Fast-paced trading with small targets |

| 15-Min to 1-Hour | Intraday Traders | Same-day entries and exits |

| 4-Hour to Daily | Swing Traders | Holding for days or weeks |

| Daily to Weekly | Position Traders | Long-term trend-based trading |

Best Timeframes for Candlestick Patterns by Style

🔹 Scalping (1-Min to 5-Min)

- Use with caution—market noise is high

- Look for quick patterns like Doji, Engulfing, or Pin Bars

- Always confirm with volume or trend indicators

✅ Recommended only for advanced traders

🔹 Intraday Trading (15-Min to 1-Hour)

- Great for patterns like Morning Star, Engulfing, and Shooting Star

- Combine with support/resistance and volume

- Best for short-term trend reversals and breakouts

✅ Popular timeframe for active traders

🔹 Swing Trading (4-Hour to Daily)

- Ideal for high-reliability patterns like Three White Soldiers, Evening Star

- Provides fewer but stronger setups

- Combines well with RSI, MACD, or moving averages

✅ Best balance of signal strength and trade frequency

🔹 Position Trading (Daily to Weekly)

- Best for long-term pattern formation like Triangles, Flags, and Reversals

- Perfect for patterns backed by macro news or earnings

- Requires patience but offers strong reliability

✅ Suitable for investors and trend followers

Best Timeframes by Market Type

| Market | Best Timeframes |

|---|---|

| Stocks | Daily, 4H, and Weekly |

| Forex | 1H, 4H, and Daily |

| Crypto | 4H and Daily for reliability; 15-min for active trading |

| Indices/Futures | 1H and Daily for clean setups |

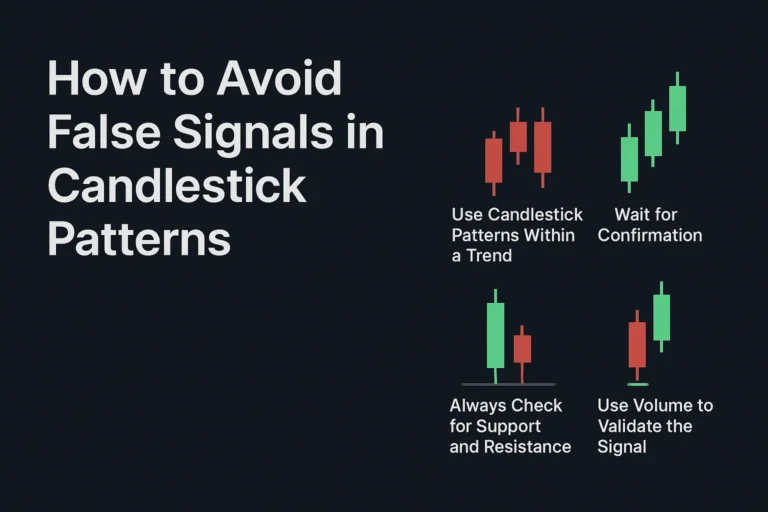

Tips for Choosing the Right Timeframe

- Match with your trading style: Don’t use daily charts for scalping or 1-min charts for swing trades

- Avoid overtrading: Lower timeframes create more signals, not better ones

- Zoom out for confirmation: Check the next higher timeframe for trend direction

- Stick to 1–2 timeframes consistently for clean analysis

Real-Life Example

A Bullish Engulfing pattern on a 5-minute chart may fake you out, while the same pattern on a 4-hour chart after a downtrend often delivers reliable results. Always consider market context and timeframe strength.

Conclusion

There’s no one-size-fits-all answer for the best timeframe to use candlestick patterns. However, higher timeframes (1H and above) offer more reliable signals, especially for new traders. As you gain experience, you can explore faster charts with proper risk controls.

Let your trading goals and strategy decide the best timeframe—not the temptation of frequent entries.

FAQs

1. Are candlestick patterns more reliable on higher timeframes?

Yes. The higher the timeframe, the more market participants are involved, making the pattern stronger.

2. What’s the best timeframe for beginners?

Start with the daily or 4-hour charts for clearer patterns and less noise.

3. Can I use multiple timeframes for confirmation?

Yes. Many traders use a lower timeframe for entry and a higher one for trend direction.

4. Do candlestick patterns work in crypto?

Absolutely. But use 4H or daily charts for more accuracy in volatile crypto markets.

5. Is there a universal best timeframe?

No. The best timeframe depends on your trading style, strategy, and risk tolerance.