Psychology Behind Candlestick Patterns: What Traders Miss

Candlestick patterns are more than just shapes on a chart — they represent the psychology of buyers and sellers battling in real time. Understanding this psychology helps traders look beyond the candle and truly interpret what the market is trying to say.

In this article, we’ll break down the emotional forces behind popular candlestick patterns and reveal what most traders miss when reading charts.

Why Psychology Matters in Candlestick Patterns

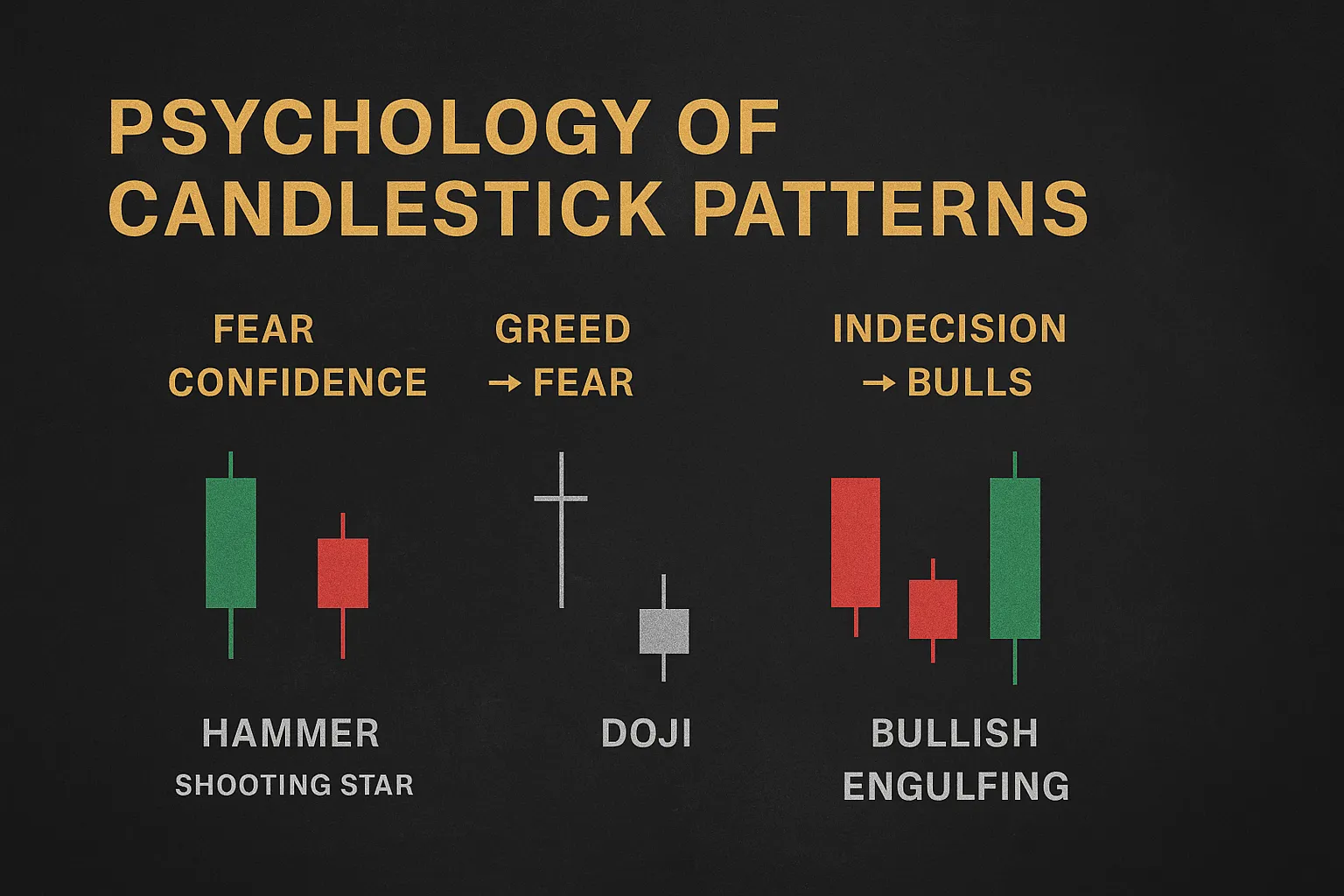

Every candlestick tells a story of market sentiment. Whether it’s fear, greed, indecision, or confidence — these emotions drive price action. When you understand what traders are feeling at key moments, you gain an edge that indicators alone can’t offer.

Candlestick patterns are visual records of human behavior in the market.

Emotions Behind Key Candlestick Patterns

Let’s look at some popular patterns and decode the trader psychology behind them.

🔹 Hammer (Bullish Reversal)

- Story: Sellers try to push price down but buyers fight back and close near the high.

- Psychology: Fear at the bottom, followed by renewed confidence from buyers.

- Common Mistake: Ignoring volume or placing trades without confirmation.

🔹 Shooting Star (Bearish Reversal)

- Story: Buyers push price higher but sellers slam it back down by the close.

- Psychology: Greed turns into fear as buyers lose control.

- What Traders Miss: The signal is stronger near resistance, not in a ranging market.

🔹 Doji (Indecision)

- Story: Price opens and closes at the same level after swinging both ways.

- Psychology: Market is uncertain; buyers and sellers are in balance.

- Risk: Traders often jump the gun without waiting for confirmation from the next candle.

🔹 Bullish Engulfing

- Story: A small bearish candle is overpowered by a strong bullish one.

- Psychology: Bears lose confidence; bulls take full control.

- What to Watch: Appears after a downtrend and near support for best results.

🔹 Evening Star

- Story: Buyers lead, then pause, and finally sellers take over with conviction.

- Psychology: Optimism fades into doubt, then reverses into fear.

- Insight: Perfect example of a shift in crowd behavior.

The Three Stages of Market Psychology in Candles

- Initiation – The first candle represents the current trend (bullish or bearish momentum).

- Transition – The second candle shows hesitation or challenge (Doji, Spinning Top).

- Confirmation – The third candle confirms a shift in control (big body in the opposite direction).

Understanding these stages helps traders anticipate moves instead of reacting to them.

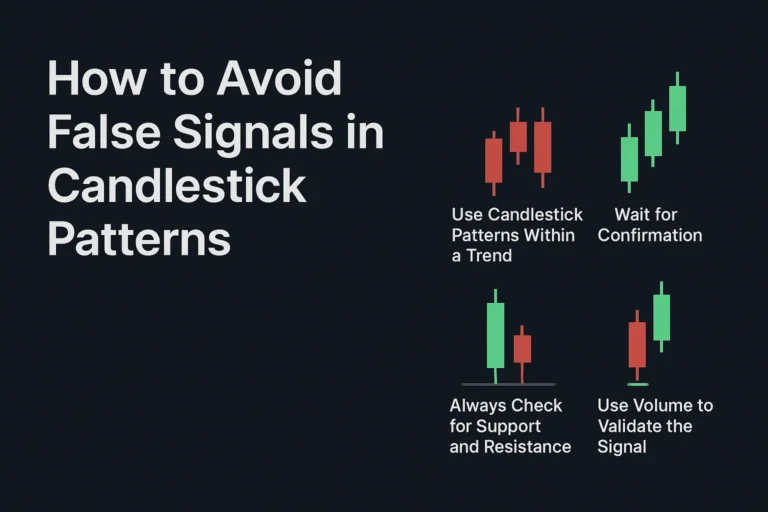

What Most Traders Miss

- They focus only on the shape of the candle, ignoring context.

- They don’t consider market structure (support/resistance, trend).

- They ignore volume, which shows conviction behind the pattern.

- They fail to think like the other side (ask: what would I do here if I were a buyer/seller?).

Great traders read intentions, not just candles.

Enhancing Pattern Reliability with Psychology

To go beyond surface-level candlestick reading:

✅ Ask what the market participants are feeling.

✅ Combine patterns with support/resistance for clarity.

✅ Look for patterns after trends, not during sideways action.

✅ Wait for confirmation candles before entering.

✅ Use patterns as signals of behavior, not absolute commands.

Conclusion

Candlestick pattern psychology is the missing piece for many traders. When you understand the emotional battle behind every candle — fear, greed, hesitation, conviction — you start trading with more confidence and clarity.

Don’t just memorize patterns. Learn to feel the market through them.

FAQs

1. Is it necessary to understand psychology to use candlestick patterns?

Yes. Patterns work better when you understand the emotional drivers behind them.

2. Can psychology improve trade timing?

Absolutely. It helps avoid false signals and wait for better confirmation.

3. Does volume affect candlestick psychology?

Yes. High volume confirms the emotional conviction behind a pattern.

4. Should I always wait for confirmation candles?

In most cases, yes. It adds reliability to pattern-based decisions.

5. Are some patterns more psychological than others?

Yes. Doji, Hammer, and Engulfing patterns often have clearer emotional implications.