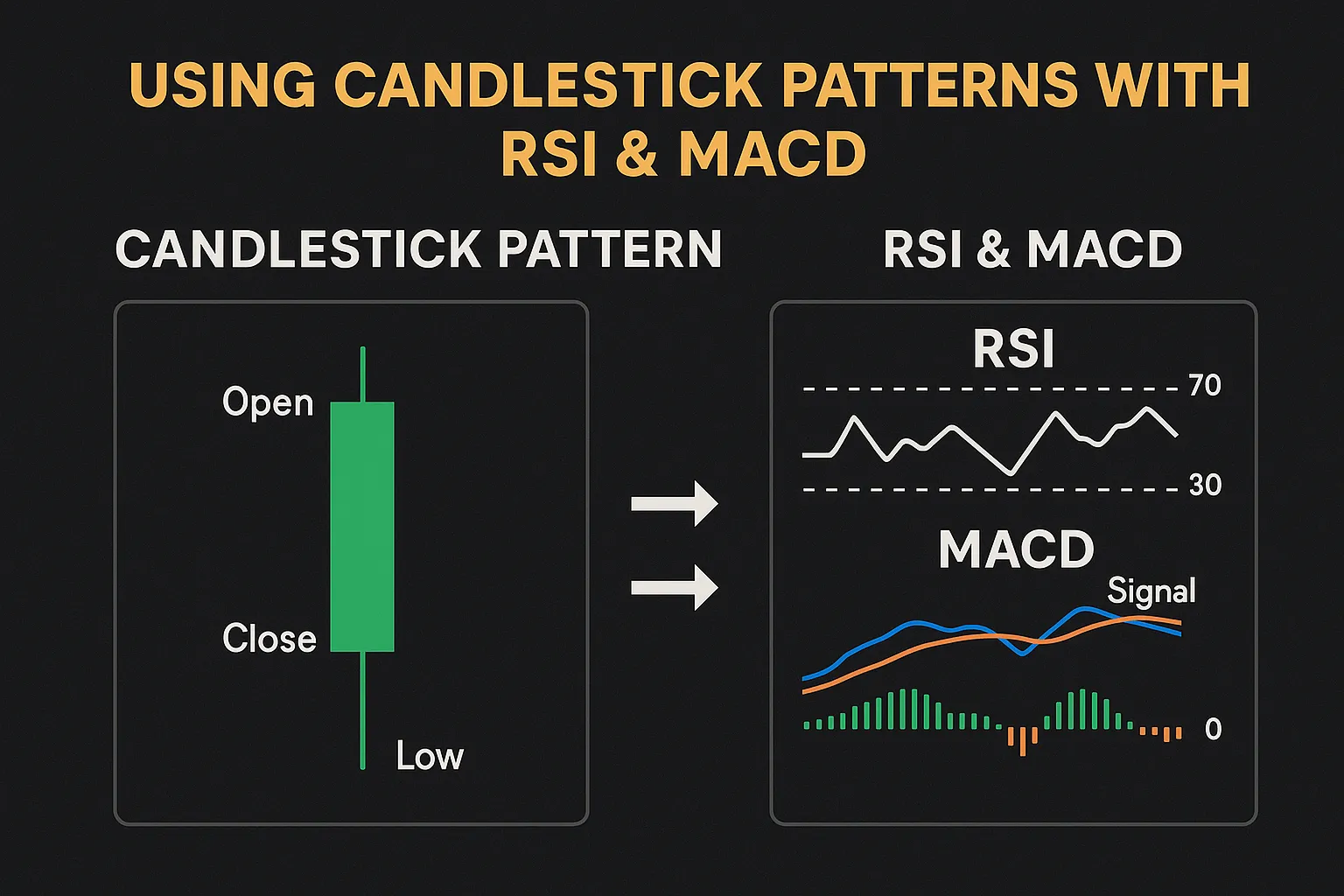

Using Candlestick Patterns with RSI & MACD for Accuracy

Candlestick patterns offer a clear view of market sentiment, but combining them with technical indicators like RSI and MACD can greatly increase your accuracy and confidence. Together, they form a powerful confluence that helps traders make better decisions.

In this guide, you’ll learn how to effectively use candlestick patterns with RSI and MACD to boost your trading edge.

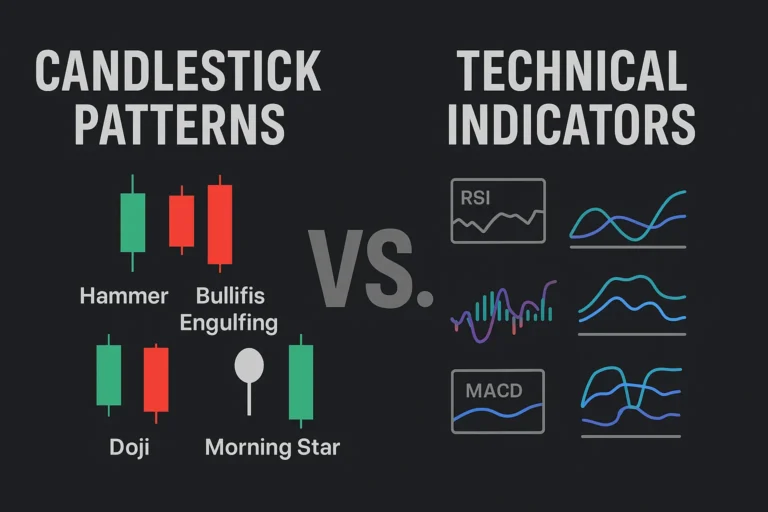

Why Combine Candlestick Patterns with Indicators?

Candlestick patterns are visual signals, while RSI and MACD are mathematical indicators. Using them together provides:

- Confirmation of signals

- Improved accuracy of trade setups

- Reduced false entries

- More reliable trend and momentum insight

Candlesticks show what is happening, while RSI and MACD explain why and how strong the move is.

Quick Overview: RSI & MACD

🔹 RSI (Relative Strength Index)

- Measures momentum on a scale of 0 to 100

- Overbought above 70 → potential for bearish reversal

- Oversold below 30 → potential for bullish reversal

- Use for spotting divergences and momentum exhaustion

🔹 MACD (Moving Average Convergence Divergence)

- Shows trend direction and momentum

- Consists of MACD line, Signal line, and Histogram

- Bullish crossover: MACD line crosses above Signal

- Bearish crossover: MACD line crosses below Signal

- Useful for trend confirmation and entry timing

Best Candlestick Patterns to Use with RSI & MACD

| Candlestick Pattern | Use With RSI | Use With MACD |

|---|---|---|

| Hammer | Confirm with oversold RSI | Look for MACD crossover |

| Shooting Star | Confirm with overbought RSI | MACD bearish divergence |

| Engulfing Patterns | Watch RSI cross 50 | MACD histogram reversal |

| Doji / Morning Star | Confirm trend exhaustion | MACD crossover soon after |

How to Combine Candlestick + RSI + MACD: Step-by-Step

✅ Step 1: Identify Candlestick Pattern

Look for a clear reversal or continuation pattern like:

- Bullish Engulfing

- Shooting Star

- Morning/Evening Star

✅ Step 2: Check RSI for Confirmation

- For bullish setups: RSI < 30 (oversold) or crossing above 50

- For bearish setups: RSI > 70 (overbought) or crossing below 50

✅ Step 3: Confirm with MACD

- Look for MACD line crossing signal line

- Check histogram momentum shifting direction

- Confirm trend support with MACD slope

Example 1: Bullish Setup

- A Hammer forms at support

- RSI is below 30 (oversold)

- MACD is turning upward with a bullish crossover

✅ Enter long on the next green candle

🎯 Target resistance or use 1:2 R:R

🛑 SL below the low of the Hammer

Example 2: Bearish Setup

- A Shooting Star forms at resistance

- RSI is above 70 (overbought)

- MACD line crosses below Signal line

✅ Enter short on confirmation

🎯 Target nearest support

🛑 SL above the pattern’s high

Benefits of Using RSI & MACD with Candlesticks

- Filters low-quality signals

- Adds momentum and trend context

- Helps you time entries more precisely

- Works across all timeframes and markets

Tips for Better Accuracy

- Use on 4H, Daily, or Weekly charts for stronger signals

- Don’t force trades without indicator alignment

- Avoid choppy markets—focus on clear trends and structure

- Always wait for candle confirmation after indicator support

Conclusion

Combining candlestick patterns with RSI and MACD gives traders a complete view of the market—price action, momentum, and trend strength. This confluence increases the reliability of each signal and helps you trade with more confidence and precision.

It’s a simple yet powerful strategy for both beginners and advanced traders.

FAQs

1. Can I use candlesticks without indicators?

Yes, but indicators improve accuracy by confirming market conditions.

2. Which is better: RSI or MACD?

Both serve different purposes—RSI for momentum extremes, MACD for trend and timing.

3. Do RSI and MACD work in all markets?

Yes. They work well in stocks, forex, crypto, and commodities.

4. What’s the best timeframe for this strategy?

Daily and 4-hour charts provide the most reliable signals.

5. Should I enter as soon as the candlestick forms?

No. Always wait for confirmation—either from indicators or the next candle.