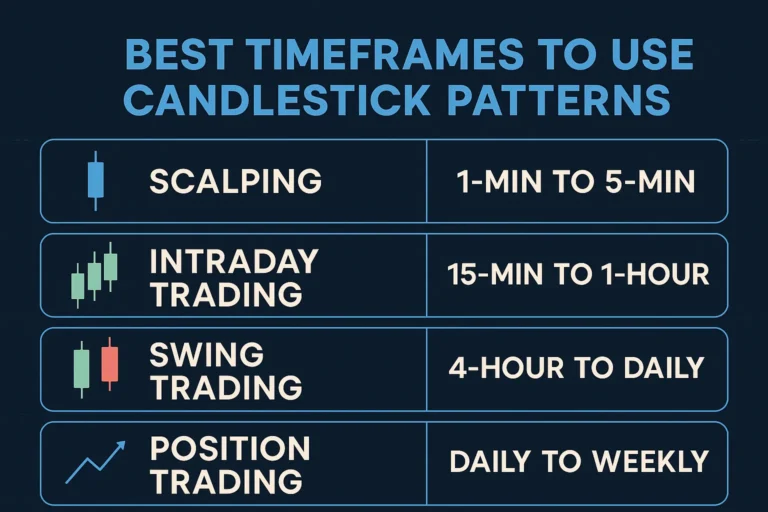

Best Timeframes to Use Candlestick Patterns

Candlestick patterns work across all markets, but their effectiveness heavily depends on the timeframe you choose. A pattern that looks strong on a 1-minute chart might be noise, while the same setup on a daily chart could signal a high-probability trade. In this guide, we’ll explore the best timeframes to use candlestick patterns, how they…